Home>Software and Apps>Which Banks Block VPN

Software and Apps

Which Banks Block VPN

Modified: September 5, 2024

Discover which banks block VPN and how it affects your access to software and apps. Learn how to navigate these restrictions and ensure seamless usage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for Techsplurge.com, at no extra cost. Learn more)

Table of Contents

Why Do Banks Block VPNs?

Banks and financial institutions have several reasons for blocking VPNs. Here are some primary concerns:

Read more: Internet Blocked by VPN

Security Risks

Banks block VPNs to prevent potential security risks. VPNs can sometimes mask IP addresses, making it difficult for banks to verify user identities. This could potentially allow malicious actors to access sensitive information or conduct fraudulent activities.

Regulatory Compliance

Financial institutions are subject to strict regulations, such as the Bank Secrecy Act (BSA) in the United States, which requires them to maintain accurate records of customer transactions. Blocking VPNs helps banks ensure compliance by having a clear and verifiable record of each transaction.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

Banks must adhere to AML and KYC regulations, which involve verifying customer identities and monitoring transactions. VPNs can complicate this process by hiding IP addresses and making it harder to track transactions.

Customer Verification

Banks often use geolocation data to verify customer locations. VPNs can mask this data, making it challenging for banks to confirm that the user is accessing their account from a legitimate location.

Read more: Bark VPN: The Solution to Internet Blocking

Compliance with International Regulations

Different countries have varying regulations regarding online banking and financial transactions. By blocking VPNs, banks can ensure compliance with local and international regulations.

Implications for Users

The blocking of VPNs by banks has significant implications for users:

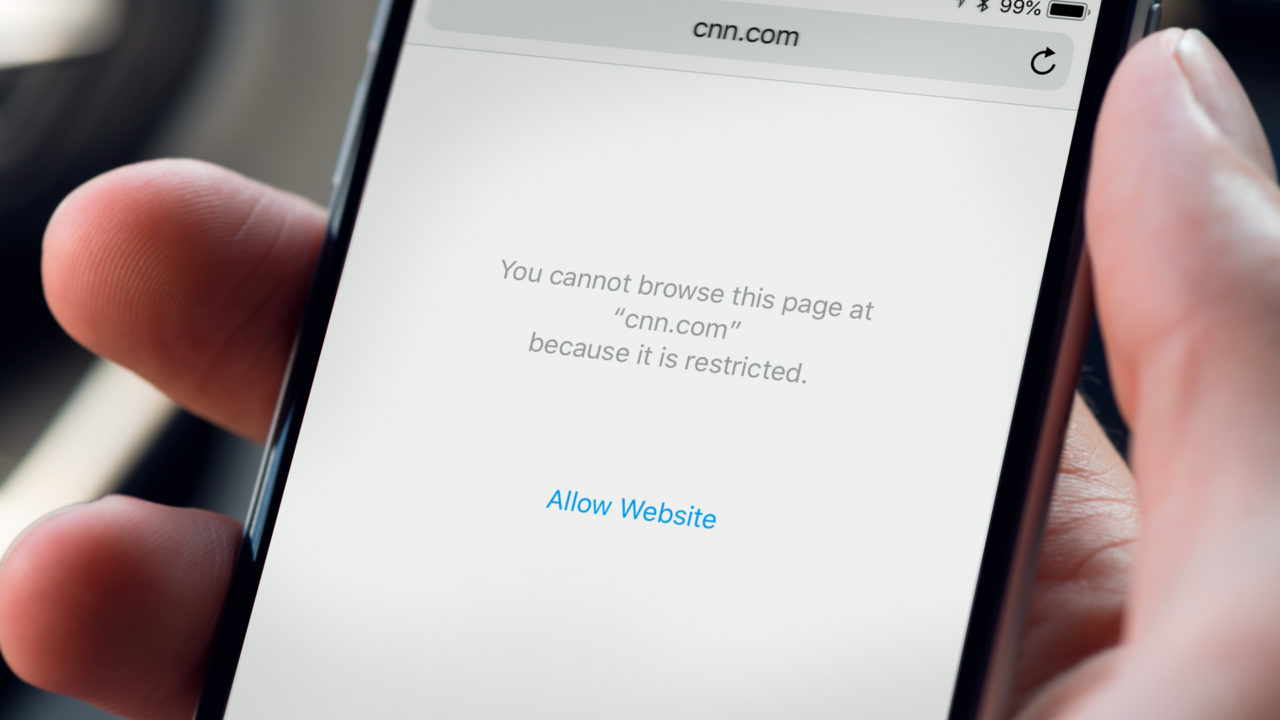

Limited Access

Users who rely on VPNs for security may find themselves unable to access their bank accounts or conduct financial transactions online.

Inconvenience

This restriction can be particularly inconvenient for users who travel frequently or live in regions with strict internet censorship.

Read more: Why Does Craigslist Block VPN

Security Concerns

Without the protection of a VPN, users may be more vulnerable to cyber threats and data breaches.

Alternative Solutions

Some users might consider using alternative security measures, such as Tor browsers or other proxy services. However, these alternatives often come with their own set of risks and limitations.

List of Banks That Block VPNs

While the list is not exhaustive, it includes some major banks and financial institutions known to block VPNs:

- Bank of America: Known to block VPNs, citing security concerns and regulatory compliance.

- Chase Bank: Blocks VPNs, emphasizing the need to verify customer identities and comply with regulatory requirements.

- Wells Fargo: Reported to block VPNs, particularly those that mask IP addresses.

- HSBC: Implemented measures to block VPNs, aiming to enhance security and comply with international regulations.

- Barclays: Taken steps to block VPNs, focusing on customer verification and AML/KYC compliance.

- Citibank: Known to block VPNs, emphasizing the importance of maintaining accurate records of customer transactions.

- Deutsche Bank: Implemented measures to block VPNs, citing security risks and regulatory compliance.

- UBS: Taken steps to block VPNs, focusing on customer verification and compliance with international regulations.

- Credit Suisse: Reported to block VPNs, aiming to enhance security and comply with AML/KYC requirements.

- Goldman Sachs: Implemented measures to block VPNs, emphasizing the need to verify customer identities and comply with regulatory requirements.

Workarounds and Alternatives

While some banks block VPNs, there are workarounds and alternatives that users can consider:

Using Bank-Specific Apps

Many banks offer mobile apps that do not require VPNs for secure access. These apps often use two-factor authentication and other security measures to protect user accounts.

Alternative Security Measures

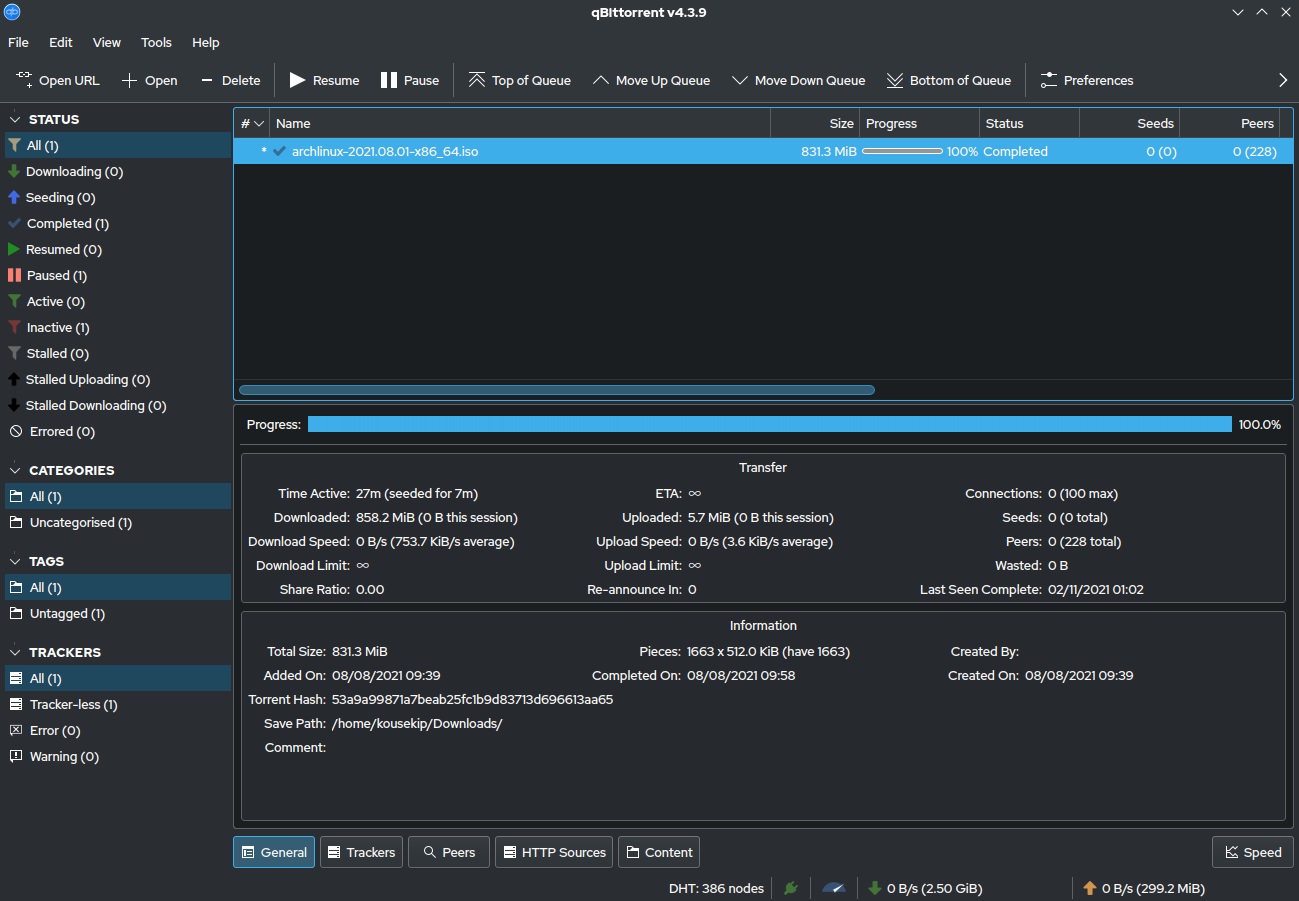

Users can consider using alternative security measures like Tor browsers or other proxy services. However, these alternatives often come with their own set of risks and limitations.

Contacting Customer Support

In some cases, users may be able to contact their bank's customer support and request an exception to use a VPN. However, this is not always guaranteed and may depend on the bank's policies.

Using Bank-Specific VPNs

Some banks offer their own VPN services or recommend specific VPN providers that are compatible with their systems. However, these options are not always available and may not provide the same level of security as a general-purpose VPN.

The blocking of VPNs by banks is a complex issue that involves balancing security risks with regulatory compliance. While it may be inconvenient for users who rely on VPNs for security, it is essential for banks to maintain accurate records of customer transactions and comply with international regulations. Users should be aware of the implications of this trend and explore alternative security measures or workarounds to ensure their online security and privacy. As technology continues to evolve, it is likely that banks will find new ways to balance security with user convenience, potentially leading to more flexible policies regarding VPN usage in the future.